How to earn From Your Cryptocurrency?

One of the best ways for building and maintaining wealth is by earning passive income. Any average high-net-worth individual will have different income streams, with at least one of them being passive. This indicates that they are not actively trading their time for money, but they are getting their money to work for them.

Since the traditional financial system is down and with low interest on a savings account, the crypto industry can offer better opportunities than the traditional system for people with additional money to earn a passive income simultaneously with their active income. In this article, we will take a look at investments and strategies that anyone can use to earn passive income with cryptocurrency from your home.

Mining

Arguably, one of the best ways to earn passive income with cryptocurrencies is through mining. This process is based on a consensus algorithm called Proof of Work (PoW), by which transactions between users are verified and added to the blockchain public ledger. Moreover, the mining process is also accountable for launching new coins into the existing circulating supply.

In the early days of cryptocurrency, Bitcoin mining was done on an everyday Central Processing Unit (CPU). But, as the network hash rate increased, most of the miners started using more powerful Graphics Processing Units (GPUs). And, as the competition increased more, it has certainly become the playing field of Application-Specific Integrated Circuits (ASICs) – electronics that use mining chips tailor-made for this specific purpose.

While mining provides a convenient passive income opportunity for cryptocurrency investors, it comes with a substantial amount of risk due to fluctuating crypto prices and mining difficulties. Moreover, the process of mining is very costly and resource-intensive. Hence, investors no longer earn hefty profits from their own mining efforts. Instead, mining is mostly performed by large mining farms using hundreds of ASICs and huge amounts of electricity.

As such, mining has mostly become a corporate business rather than a viable source of passive income for an average individual. Also, it’s worth noting that setting up and maintaining mining equipment requires an initial investment and some technical expertise.

Lending

This is another way to earn income on your cryptocurrency holdings. There are numerous peer-to-peer (P2P) lending platforms that allow you to lock your assets for a specific period of time and generate interest payments. You can lend cryptocurrency to crypto businesses or professional crypto traders who are in need of funding. The interest rate on crypto lending can either be fixed (set by the platform) or set by you based on the current market rate.

However, lending cryptocurrency carries a potential risk as the borrower could default on your loan. Therefore, it’s important for you to diversify your crypto loan portfolio to a number of loans and check the details of each borrower before lending your coins.

Earn Interest on Crypto

Theoretically, a crypto interest-earning account works just like a regular savings bank account. You need to deposit your crypto coins with no lock-in period or deposit limits, and your deposited asset earns interest. You’ll receive payouts and can withdraw your funds at any time.

The interest rate on the cryptocurrency is driven by various market factors and is paid out in the same cryptocurrency that you have in your wallet. There is a withdrawal fee that is regularly adjusted according to the exchange platform.

It’s important for you to note that when compared to traditional market rates, the interest rates within the crypto markets are incomparable, where you need to think of it as a trade-off between risk and reward.

Staking

Staking cryptocurrencies is another excellent way to earn passive income; however, this process requires a certain amount of technical expertise. Hence, it is essential for you to get familiarized with the process of staking for the particular cryptocurrency project you are interested in before investing time and money in this passive income opportunity.

The process of staking is based on a consensus algorithm called Proof of Stake (PoS). Also, staking requires buying certain cryptocurrencies that run on the PoS. Any person who holds coins can lend coins to the network, which will be used for validating transactions. The more coins you lend, the more the network will reward you.

Overall, staking is a great way for earning passive income as the market pays you for holding cryptocurrencies for a certain period. It also offers a potential return on investment that is more predictable than others.

Airdrops

An airdrop is a marketing activity that involves the free delivery of a cryptocurrency token or coin to several wallet addresses. They are generally used to promote awareness, gain new followers, leading to a larger user base and more coins being distributed.

Cryptocurrency airdrops are usually advertised on cryptocurrency forums or the company’s website. Small amounts of the new virtual currency are sent to the wallets of active members for free or in return for small services.

To be eligible for an airdrop, a crypto user must have some amount of cryptocurrency balance in their wallets. Moreover, users may also need to complete a specific task, such as introducing others to the newly created cryptocurrency or posting about the cryptocurrency on any social media forum, among others.

Holding Dividend-Paying Tokens

This is one of the easiest ways to earn passive income in the cryptocurrency market. Here, you have to buy and hold dividend-paying tokens. Though such tokens are not common, the main type of digital tokens that pay a dividend is exchange-issued tokens. Nowadays, many exchanges have issued their tokens, which provide users with discounts on trading fees.

To earn dividends on such types of digital tokens, users are usually required to stake them using an external wallet or hold them on the issuing exchanges. The more digital token you hold or stake, the more passive income you earn.

ALL Reviews

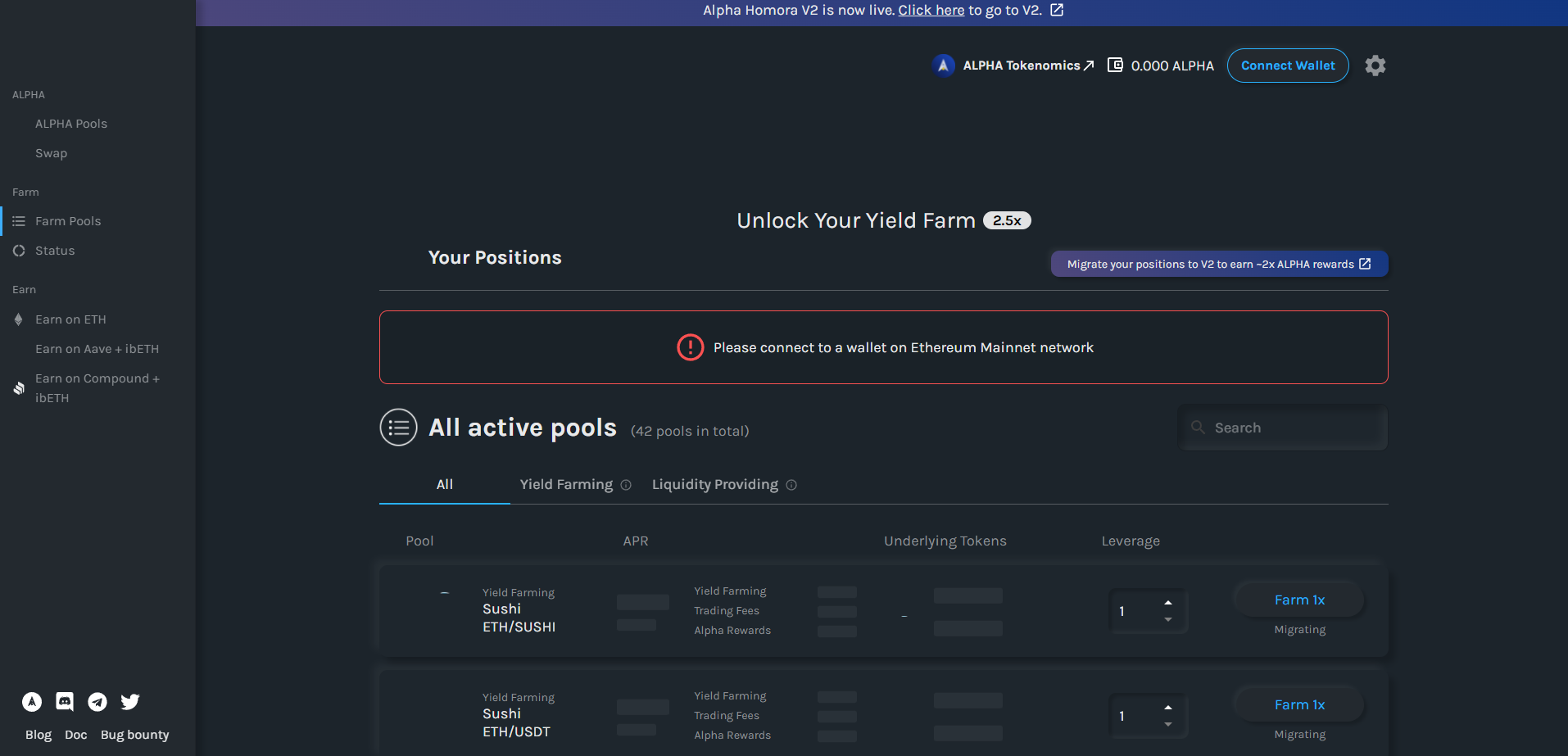

ALPHA HOMORA

- Single easy to use access portal

- Can easily import positions from other DeFi protocols like Maker and Compound

- Can build extensible use-cases and models with maximum security

- High TVL (Total Value Locked)

Background Information About Alpha Homora

It is a product of Alpha Finance Lab where users can participate as yield farmers, liquidity providers, ETH lenders, liquidators, and bounty hunters.

Alpha Homora is the go-to aggregate yield farming protocol that brings a better user experience and maximizes alpha on your yield farming positions with its unique features, such as optimal swap functionality, loss-minimizing/gas-saving features, and automatic reinvestment functionality.

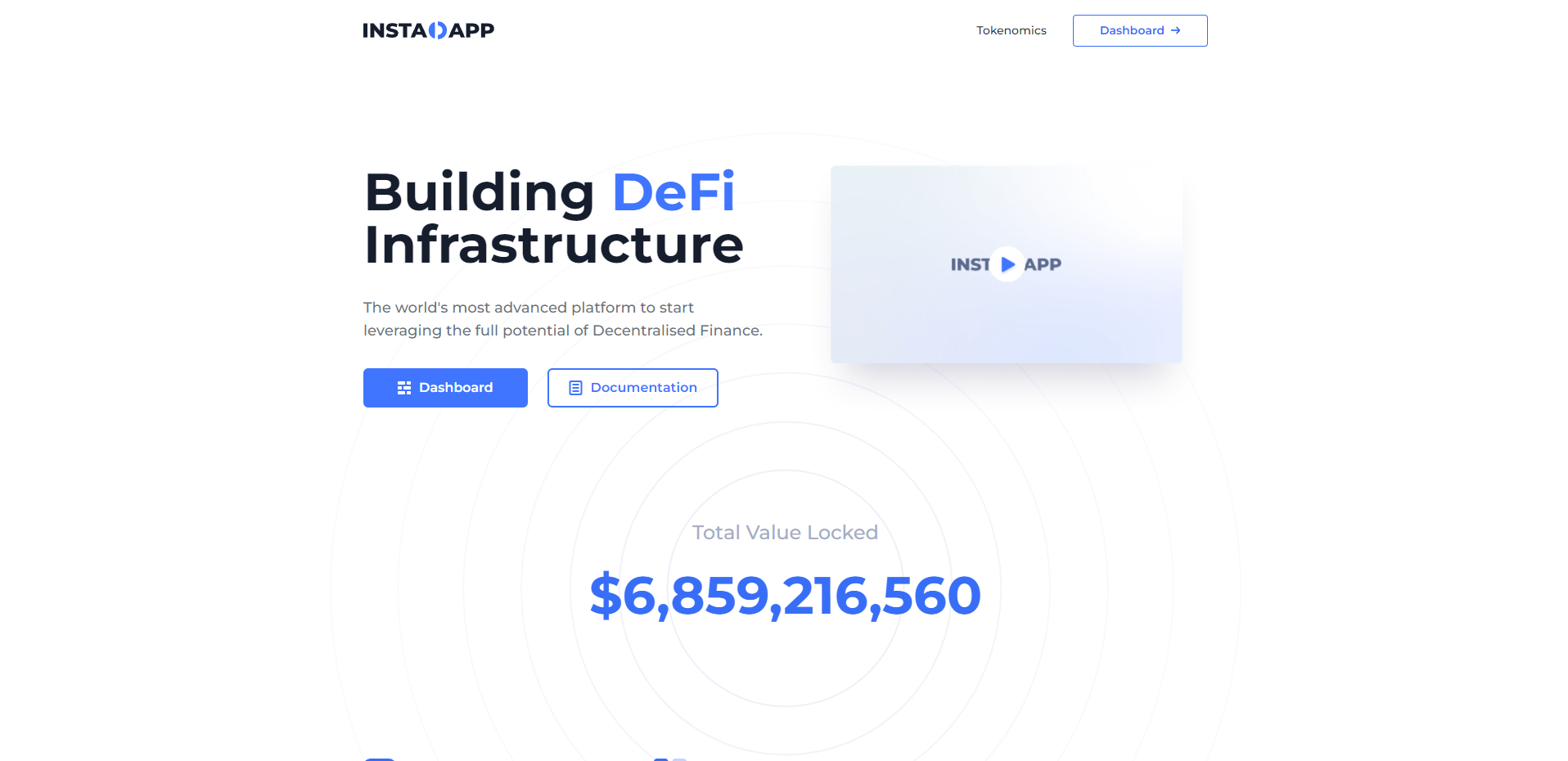

INSTADAPP

- Single easy to use access portal

- Can easily import positions from other DeFi protocols like Maker and Compound

- Can build extensible use-cases and models with maximum security

- High TVL (Total Value Locked)

Background Information About InstaDapp

Founded in 2018 by Samyak Jain and Sowmay Jain, InstaDapp is a DeFi middleware for users and developers to seamlessly manage multiple DeFi applications to maximize returns in various protocols in a fraction of the time.

The Instadapp protocol (‘DSL’) acts as the middleware that aggregates multiple DeFi protocols into one upgradeable smart contract layer. This structure allows Instadapp to access the full potential of Decentralized Finance. With Instadapp, developers can build use-cases and monetize their models to earn money by serving their users with high reliability.

PANCAKESWAP

- Easy-to-use interface

- High APR/APY returns

- Offers a variety of products

- Huge total value locked (TVL)

- Active developers and community

Background Information About PancakeSwap

PancakeSwap is a DEX (decentralized exchange) built on top of the Binance Smart Chain (BSC) and facilitates the swapping of one crypto with another crypto. On PancakeSwap, you can swap BEP-20 tokens quickly and safely.

PancakeSwap is one of the most popular decentralized platforms today. A DAPPRadar report released in May this year, PancakeSwap has 1.7 million users. It also has a native token, a BEP-20 token on the BSC. The CAKE token is at the heart of the PancakeSwap ecosystem.

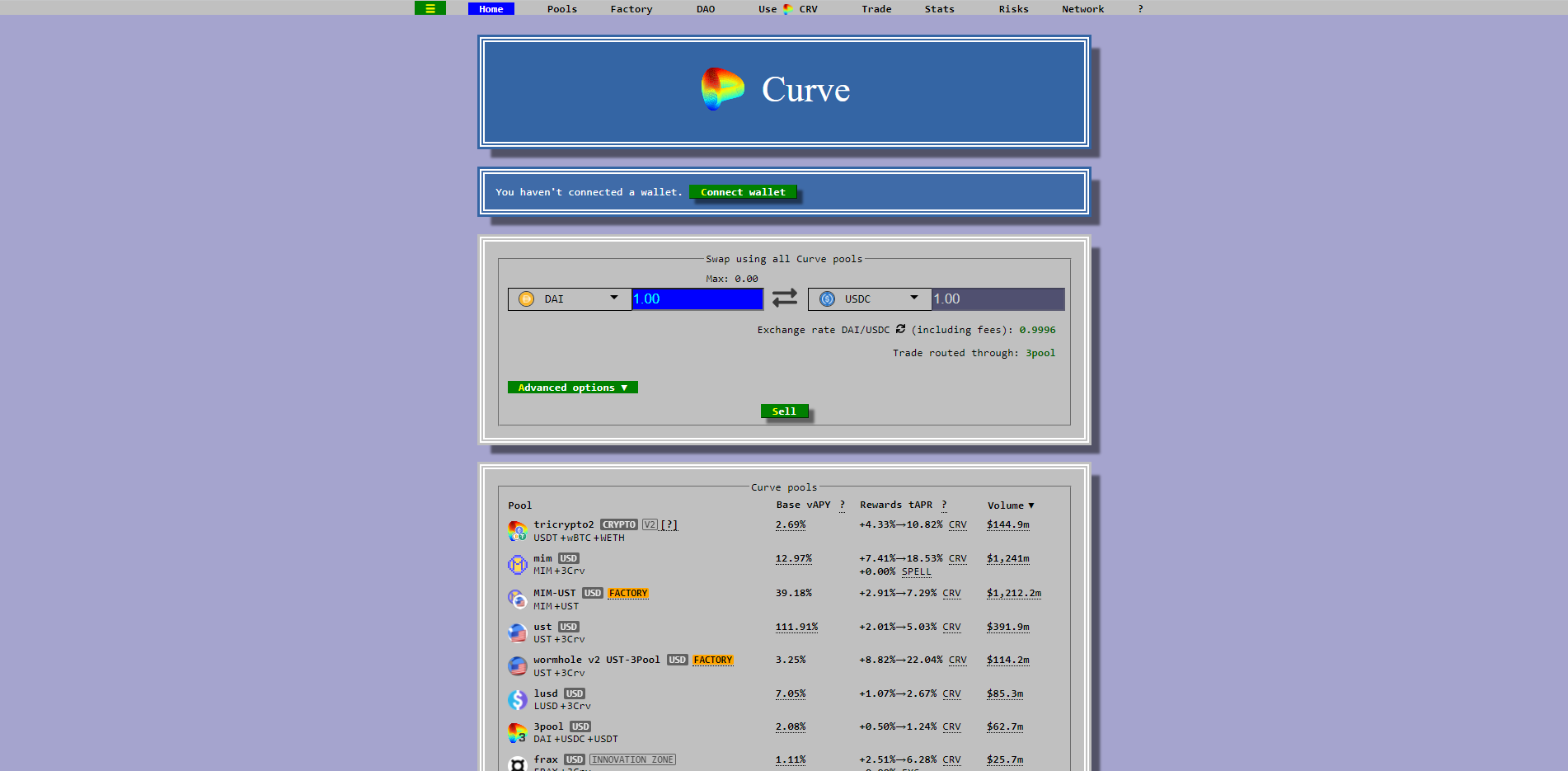

CURVE FINANCE

- Large number of liquidity pools to select from

- Virtually unmatched exchange rates on stablecoins

- Has some of the largest liquidity/volumes of any DEX

- Decentralized with good incentives for CRV holders

- Supports yield farming at low-interest rates

Background Information About Curve Finance

Headquartered in Switzerland, Curve Finance serves as one of the largest DeFi platforms by volume and has amassed tremendous liquidity since its launch. Michael Egorov is the CEO of Curve Finance.

One of the easiest ways to understand Curve Finance is to see it as an exchange. It is a decentralized exchange liquidity pool built on Ethereum, allowing the stablecoin trading and liquidity pool providers to earn income from trading fees with minimal risk. Curve Finance protocol gives users and smart contracts the ability to trade between stablecoins with low slippage and fees due to its high available liquidity. Moreover, it is non-custodial, meaning the Curve developers do not have access to your tokens.

YEARN FINANCE

- Easy-to-use interface

- High Total Valued Locked (TVL)

- Offers some of the highest returns on investments

- Maintains a high level of security

- Supports yield farming at low-interest rates

Background Information About Yearn Finance

Founded in 2020, Yearn Finance is a suite of products in Decentralized Finance (DeFi) that provides lending aggregation, yield generation, and insurance on the Ethereum blockchain. The protocol is maintained by various independent developers and is governed by YFI holders. Andre Cronje is the founder and CEO of the company.

Yearn Finance is an entirely new decentralized finance application that is intended to enable its users to obtain a high annual percentage yield (APY) from their investments. The platform offers few products, including:

MAKER

- Transparent platform

- Available in multiple languages

- Provides price-stable currency that you can control

- The community of MKR token holders governs the Maker Protocol

- Over 400 apps and services have integrated Dai, including wallets, DeFi platforms, games, and more

Background Information About Maker

Founded in 2014 by Rune Christensen, MakerDAO is a decentralized governance community that enables the generation of Dai, the world’s leading decentralized stablecoin. Users lock their Ethereum in a CDP (Collateralized Debt Position) smart contract, and in return, they receive DAI as a loan. The decentralized governance community of MakerDAO manages the generation of DAI through an embedded governance mechanism within the Maker Protocol.

SUSHISWAP

- The tokens at SushiSwap are delivered to your wallet instantly within a few seconds.

- Exchange, lend, borrow, farm, and provide liquidity

- Secure platform

- Available in multiple languages

Background Information About SushiSwap

Founded in 2020 by Ox Maki, SushiSwap is a peer-to-peer, decentralized exchange. It allows users to swap tokens, provide liquidity, and other DeFi services. Based in Japan, SushiSwap operates a decentralized finance liquidity provision platform.

The first product from Sushi is SushiSwap, a decentralized exchange. It is also non-custodial, which means that, unlike centralized exchanges, it does not need to possess your tokens for you to be able to trade them. Instead, SushiSwap allows users to trade with liquidity supplied by other users. It means that new projects can easily connect to their desired markets as long as some entity is willing to provide the liquidity.

BALANCER

- Fully decentralized market maker protocol

- High liquidity

- Plug and play options

- Intelligent pricing

- Permissionless platform

Background Information About Balancer

Balancer is an automated portfolio manager, liquidity provider, and price sensor. It enables portfolio owners to create Balancer Pools where traders can then trade against these pools. Balancer is still a relatively new liquidity provider (LP) in the decentralized finance (DeFi) space.

It is based on an N-dimensional invariant surface which is a generalization of the constant product formula described by Vitalik Buterin and proven viable by the popular Uniswap dapp.

UNISWAP

- User-friendly interface

- More than 200 DeFi integrations

- High liquidity

- Integrated with 100+ exchanges and trading venues across the globe

Background Information About Uniswap

Founded in 2018 by Hayden Adams, Uniswap is a fully decentralized protocol for automated liquidity provision on Ethereum. The platform empowers developers, liquidity providers, and traders to participate in a financial marketplace that is open and accessible to all.

In September 2020, Uniswap launched its token UNI. It enabled Uniswap to bring community governance to the Uniswap community. Not only that, but it also enabled scores of its users to stake their UNI token and make more profits. It was a major move to make Uniswap a truly decentralized protocol.

AMBER GROUP

- Easy-to-use platform

- Available in over 140 countries

- Over $1.5 billion in assets under management

- Integrated with 100+ exchanges and trading venues across the globe

- Partnered with industry-leading security infrastructure providers for security

Background Information About Amber Group

Headquartered in Hong Kong, Amber Group is a well-known name in the crypto space. Founded by a group of finance professionals from Morgan Stanley, Goldman Sachs, and Bloomberg in 2017, Amber group provides a variety of crypto services.

Amber Group services over 500 institutional clients and has cumulatively traded over $500 billion across 100+ electronic exchanges, with over $1.5 billion in assets under management. In 2021, Amber Group raised $100 million in Series B funding and became the latest FinTech unicorn valued at over $1 billion. It makes Amber Group one of the largest companies in the crypto space globally.

VAULD

- User-friendly interface

- Lending, borrowing, and trading of crypto assets available

- Supports multiple currencies like Bitcoin, Ethereum, XRP, BAT, XLM, USDT, among others

- Can instantly swap between the supported cryptocurrencies and FIAT

- No fees on deposits and withdrawals

Background Information About Vauld

Founded in 2018, Vauld is a crypto platform that helps you manage your cryptocurrencies and allow you to lend, borrow, and trade crypto assets. Headquartered in Singapore, Vauld was co-founded by Darshan Bathija and Sanju Sony Kurian.

The company aims to provide you with a customer-centric solution and leverages blockchain technology to do so. With Vauld, you can instantly swap between supported cryptocurrencies and fiat currencies (government-issued currencies). Additionally, they help you grow your capital by earning interest.

COMPOUND FINANCE

- Easy-to-use interface

- High liquidity

- Available globally

- High level of privacy

- No time limitation as users are allowed to borrow or lend assets for an indefinite period

Background Information About Compound

Founded in 2017 by Geoffrey Hayes and Robert Leshner, Compound Finance is an open-source interest rate protocol that unlocks new financial applications for developers.

Built on the Ethereum blockchain, you can access Compound Finance protocol using several interfaces such as Coinbase and Huobi wallets. It offers a web interface that adjusts money market interest rates based on asset-specific supply and demand.

BANCOR

- Supports a significant number of ERC20 tokens

- Low counterparty risk

- Competitive costs of trading

- High liquidity

Background Information About Bancor

Founded in 2016, Bancor is a permissionless decentralized protocol that allows traders, liquidity providers, and developers to exchange a variety of tokens effortlessly. The company was co-founded by Eyal Hertzog, Galia Benartzi, Guy Ben-Artzi, Yudi Levi and is owned and operated by its community as a decentralized autonomous organization (DAO).

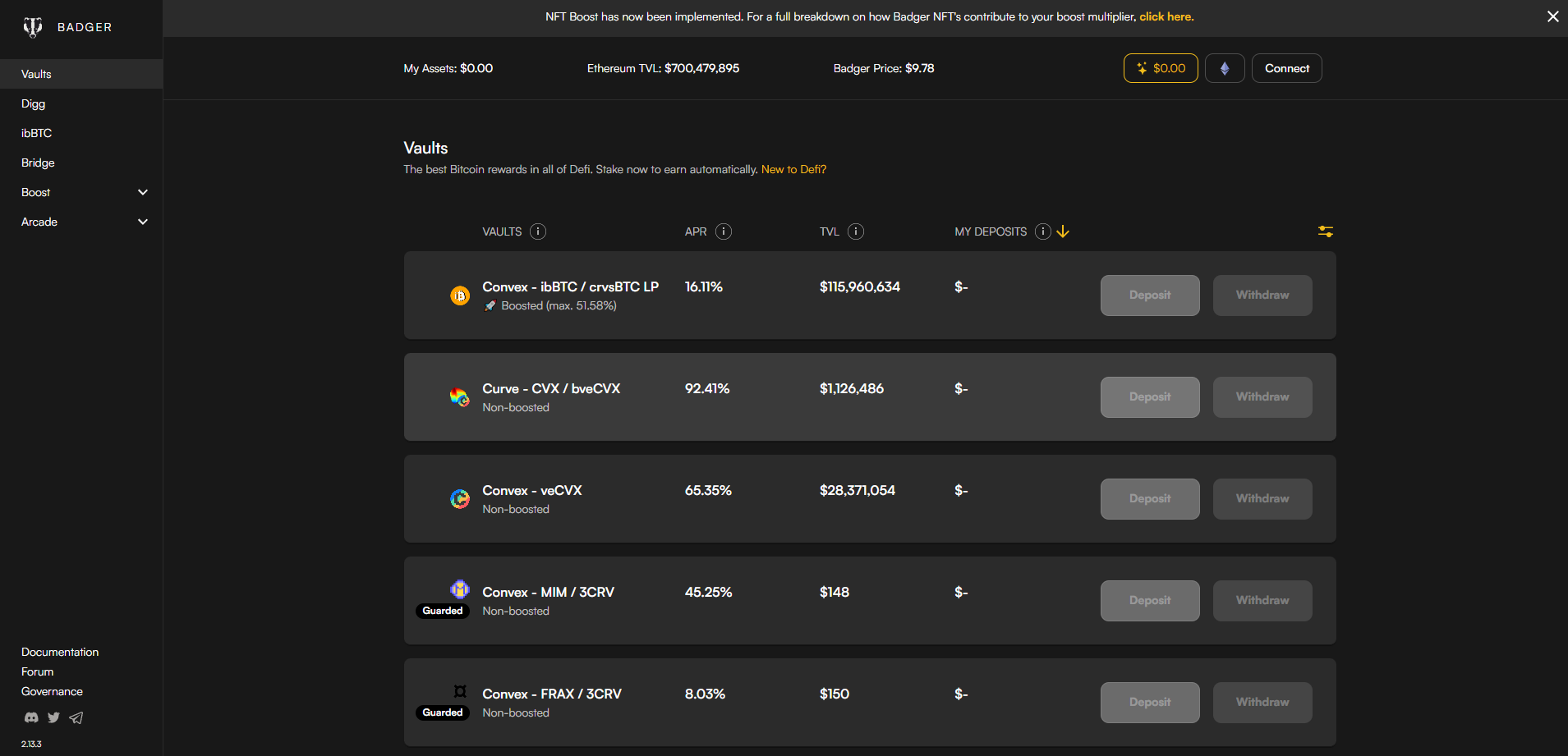

BADGER DAO

- Easy-to-use interface

- High TVL (Total Value Locked)

- Badger tokens can be used to earn staking rewards and as collateral on different platforms

Background Information About Badger DAO

Founded in 2020, Badger is meant to be an ecosystem DAO where projects and people from across DeFi can come together to collaborate and build the products our space needs.

BADGER is the native token of Badger DAO. It is an ERC-20 token, and its main utility is that it allows its holders to take part in the governance of the DAO and all of its products. It can also be used to earn staking rewards and as collateral on different platforms and chains.

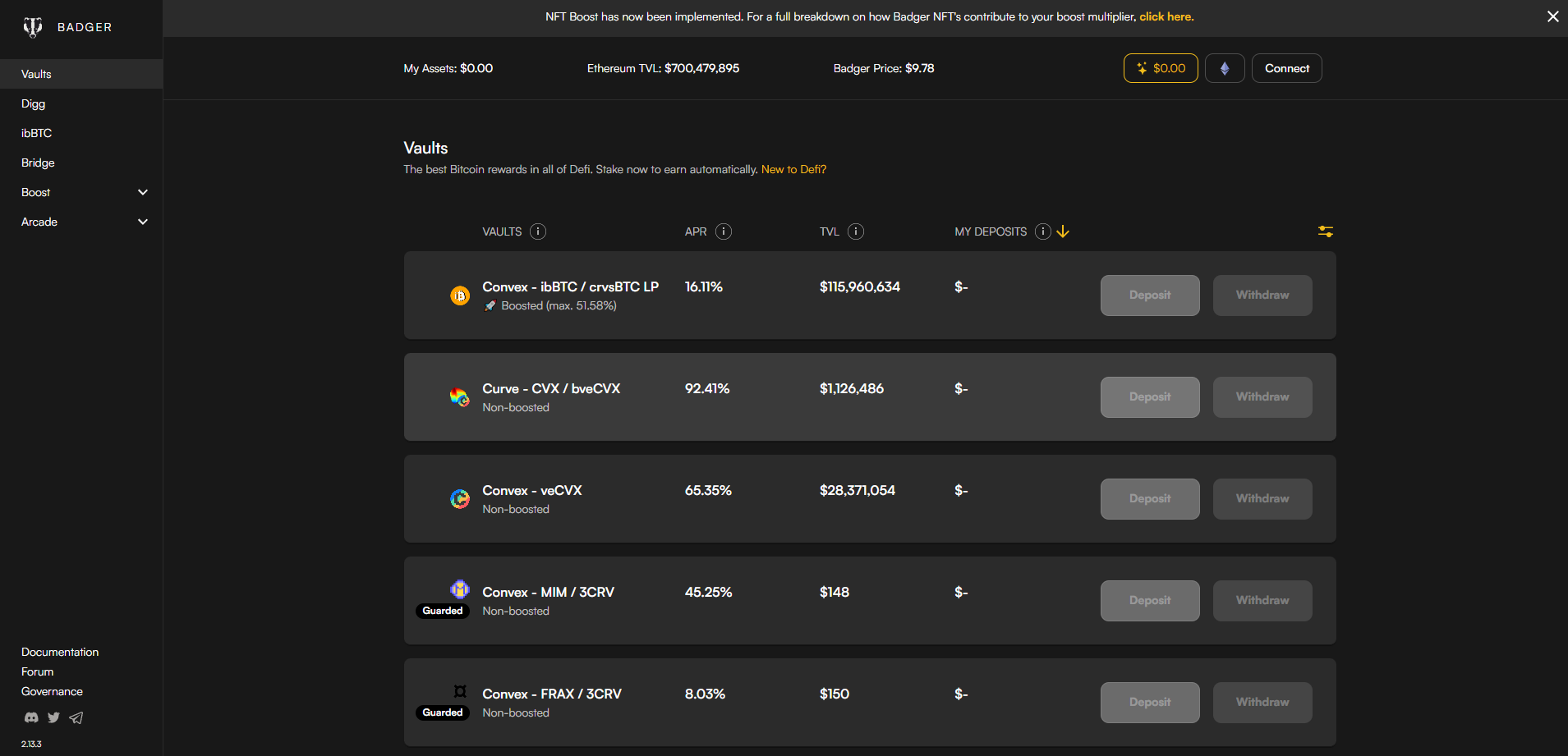

BADGER DAO

- Easy-to-use interface

- High TVL (Total Value Locked)

- Badger tokens can be used to earn staking rewards and as collateral on different platforms

Background Information About Badger DAO

Founded in 2020, Badger is meant to be an ecosystem DAO where projects and people from across DeFi can come together to collaborate and build the products our space needs.

BADGER is the native token of Badger DAO. It is an ERC-20 token, and its main utility is that it allows its holders to take part in the governance of the DAO and all of its products. It can also be used to earn staking rewards and as collateral on different platforms and chains.

Frequently asked questions for beginners

1. Is Vauld trustworthy?

Vauld has been operating in the crypto environment since 2018 and has not faced any major security breach or loss of user funds. The company follows the crypto industry’s best practices to keep funds and user accounts secure.

2. How soon can I earn interest after depositing funds at Vauld?

You will start earning interest as soon as you deposit your funds.

3. How long does Vauld take to settle my withdrawals?

The withdrawal process at Vauld is instant. However, for withdrawals larger than $100K, the company manually verifies the withdrawal with the user for added security reasons. The verification process is completed in a minimum time of 6 hours.