PROS

- Supports a significant number of ERC20 tokens

- Low counterparty risk

- Competitive costs of trading

- High liquidity

CONS

- No fiat currency support

- No margin trading

Background Information About Bancor

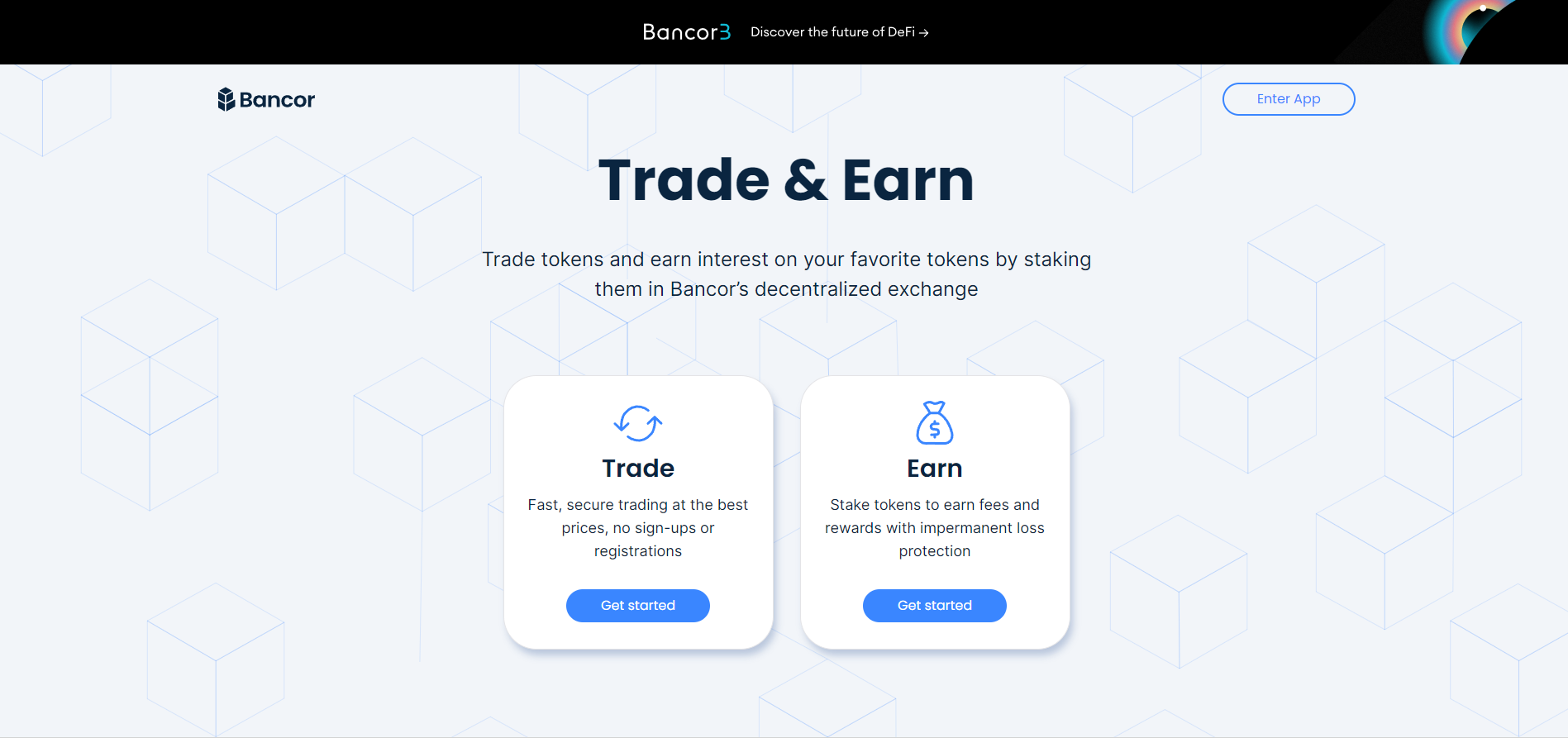

Founded in 2016, Bancor is a permissionless decentralized protocol that allows traders, liquidity providers, and developers to exchange a variety of tokens effortlessly. The company was co-founded by Eyal Hertzog, Galia Benartzi, Guy Ben-Artzi, Yudi Levi and is owned and operated by its community as a decentralized autonomous organization (DAO).

Bancor Protocol is a standard for the creation of smart tokens, cryptocurrencies with built-in convertibility directly through their smart contracts. The Bancor network allows users to swap between a pair of tokens quickly. Moreover, it also creates a platform for autonomous liquidity without the presence of any counterparty.

How to trade on Bancor?

One of the easiest ways to trade at Bancor is to use the Bancor Dapp. The Bancor network is also integrated with many decentralized exchange aggregators like X Nation, 1inch, Paraswap, and DEX. AG. While using these platforms, your trade may be routed through Bancor.

Additionally, you can trade at Bancor using the Bancor Widget, which can be embedded by third parties on their sites, and via a smart contract interface, where a third party developer has integrated Bancor into their smart contract.

Trading via Etherscan

If you are looking to trade directly on the BancorNetwork contract, then you need to use Etherscan’s web UI.

Moreover, if you are a developer looking to interface with Bancor contracts via your own smart contract, then you need to follow the below steps.

Step 1: Query for Latest BancorNetwork Address

As the Bancor contracts are regularly upgraded, the BancorNetwork may change over time. To find the most recent address-

- First, head over to the ContractRegistry contract on Etherscan

- In the Read Contract section, execute the getAddress function with the following parameter: contractName: 0x42616e636f724e6574776f726b. This is the bytes32 representation of “BancorNetwork”

- The return value you get is the address of the BancorNetwork contract.

Step 2: Generate Conversion Path

The conversion path is the plot between liquidity pools, allowing a token on Bancor to be exchanged for any other token.

In this step, it is recommended to use the Bancor SDK for generating the most efficient path between two tokens. The API call will provide you with the conversion path and expected exchange rate of trade. You have to save these inputs for the next step.

If you are looking to generate a conversion path on-chain, then the conversionPath function on the BancorNetwork contract will give you a good approximation of the best path.

Step 3: Execute a Trade

To execute a trade, you need to follow the below steps:

- Head to the Etherscan page of the contract address you queried in Step 1 and navigate to the Write Contract View

- For exchanging ether for any other token, you have to use the convert function.

- For exchanging one token for another token, you’ll be using the claimAndConvert function.

- Now, you need to use the path parameter from Step 2 and the rate return value from getPathAndRate as a reference point for how to determine the minReturn argument

- Finally, execute the correct function with the relevant inputs.

How do I stake in the Bancor protocol?

On Bancor protocol, you can swap or stake on the bancor.network or any other site integrated with Bancor smart contracts. You can connect using Web3 wallets like MetaMask. You also need to ensure that your wallet is connected by checking the connection status in the upper right-hand corner of the bancor.network. Once you connect to the wallet, you need to follow the below steps.

- Go to the bancor.network and click on the “Add Liquidity” button.

- Click on “Stake and Protect” under the Single-Sided Protection option.

- Next, you have to select if you want 100% exposure to the base ERC20 token or BNT.

- Enter the number of tokens you wish to protect. If you click on “Balance, it will select the full balance.

- Click on “Stake and Protect” and confirm the transactions in the app and Metamask(x2). On a successful transaction, your protected single-sided liquidity stake will appear on the Protection screen.

Frequently Asked Questions About Bancor

1. Is Bancor safe?

Bancor is a safe platform, and it has completed full audits with Peckshield, Certik, Halborn, and Consensys Due Diligence. Bancor also has an open and ongoing bug bounty program for any bugs found on its platform.

2. Can I use hardware wallets at Bancor?

Yes. MetaMask supports hardware wallets like Trezor and Ledger directly. There is no need to keep it connected to your PC after you’ve finished with the interactions.

3. What kind of fees can I earn at Bancor?

You will get the swap fees for swaps in one direction. The APY is dependent on trading activity and fluctuates accordingly. You also get BNT liquidity mining rewards that Bancor governance has approved for distribution to the pool.