PROS

- Fully decentralized market maker protocol

- High liquidity

- Plug and play options

- Intelligent pricing

- Permissionless platform

CONS

- Accepts only ERC-20 tokens

- No live chat support

Background Information About Balancer

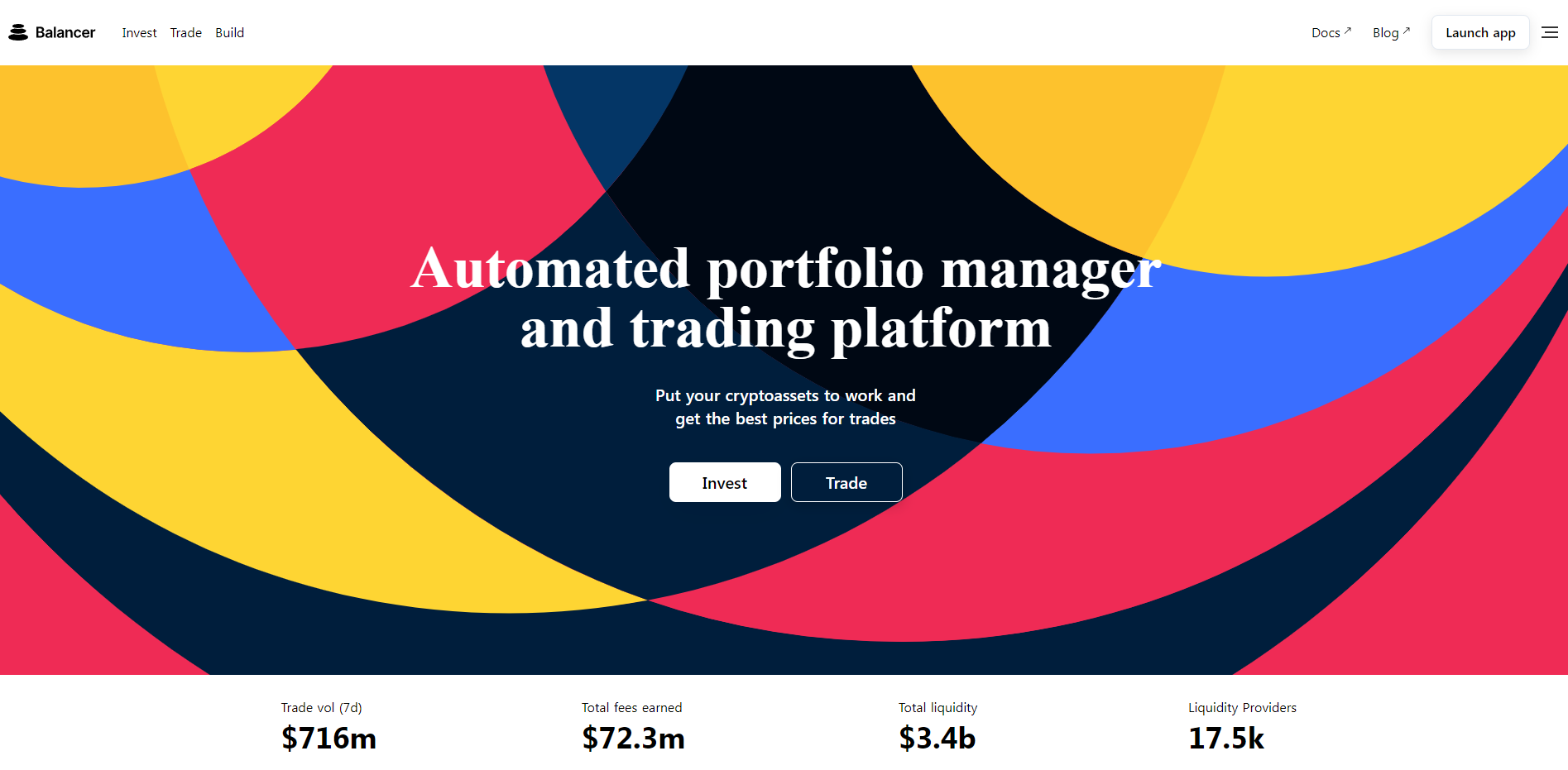

Balancer is an automated portfolio manager, liquidity provider, and price sensor. It enables portfolio owners to create Balancer Pools where traders can then trade against these pools. Balancer is still a relatively new liquidity provider (LP) in the decentralized finance (DeFi) space.

It is based on an N-dimensional invariant surface which is a generalization of the constant product formula described by Vitalik Buterin and proven viable by the popular Uniswap dapp.

The Balancer Protocol is a core building block of DeFi infrastructure—a unique financial primitive and permissionless development platform. Balancer protocol functions as a self-balancing weighted portfolio, price sensor, and liquidity provider. It allows users to earn profits through its recently introduced token ($BAL) by contributing to customizable liquidity pools.

How to Get Started at Balancer?

Balancer is an Ethereum-based DeFi app. To invest and trade here, you’ll first need to set up an Ethereum Wallet. The different wallets supported by Balancer include Metamask, Wallet Connect, Coinbase, Portis, among others.

These wallets are used to send, receive, and store digital assets. They come in different forms like an extension added to your browser, built-in your browsers, a part of hardware plugged into your computer, or even as an app on your phone. After making your setup, you can now start swapping different tokens at Balancer.

How do I Make my First Swap at Balancer?

After connecting a wallet, you can start trading at Balancer. Below is the step-by-step process:

Step 1: Visit the website of Balancer, and click on the trade button.

Step 2: Next, you have to select or enter the trade token that you want to trade.

Step 3: Select the output token you want to receive.

Step 4: Now, you have to enter the trade amount. Here, you can specify either an input amount or an output amount.

Step 5: You need to approve the token. After approving your token, you’ll get an issue of an Ethereum transaction that will have a gas cost.

Step 6: After confirming the gas fees, you can make a swap. Click swap and approve the transaction.

Step 7: Once your trade is successfully completed, you will get a receipt of your transaction.

How Does Liquidity Mining on Balancer Work?

Balancer Finance offers a community-focused Liquidity Mining Program that is maintained by a Liquidity Mining committee called “Ballers.” Each week the “Ballers” choose how token distributions are allocated to the pools. At the weekend, they vote for the liquidity mining program for the following week. If you want to check their progress, you need to go to Discord in the #liquidity-committee channel and follow their votes on their Snapshot voting space.

To see which pools receive liquidity mining incentives, you need to click on the 3-star icon next to the pool position. You can move over the icon to see the breakdown in “Swap Fees APR” and “Liquidity Mining APR”.

What Types of Fees Are There at Balancer?

Below are different types of fees at Balancer:

1. Trading Fees

Traders have to pay some percentage of trading fees to the pool LPs (Liquidity Providers). This fee is set by the pool creator or dynamically optimized by Gauntlet. In addition, the Balancer governance can vote to introduce a protocol trading fee, which is a small percentage of the trading fee.

For example, if a pool has a 1% fee, and governance introduced a 1% protocol fee- then, the total swap fee to the trader would remain at 1%; however, 0.99% would accrue to the pool’s LPs, and 0.1% would accrue to the protocol fee collector contract.

2. Flash Loan Fees

A small percentage of assets are used for flash loans from Balancer’s vault- this is the protocol fee that accrues to the protocol for allocation by governance.

At Balancer, all the protocol fees are set to zero at launch and can only be changed through governance.

Frequently Asked Questions About SushiSwap

1. Is Balancer safe?

Balancer is a safe platform, and it has completed full audits with Certora, OpenZeppelin, and Trail of Bits.

2. Is there a supply limit on BAL tokens?

The maximum total supply of BAL tokens is capped at 100 million. But, this does not mean that this limit will ever be reached. BAL token holders have the authority to decide if the distribution should end before hitting the cap.3. What are the fees for trade at Balancer?

3. What are the fees for trade at Balancer?

Each pool at Balancer can have a different fee. The pools are extremely customizable, and the pool creator decides how high the fees should be. Usually, the fees range from 0.0001% to 10%. If you are using a Smart Order Router, the fees will always be taken into account when finding the best price.