Curve Finance

Curve Finance is an exchange liquidity pool built on Ethereum designed for extremely efficient stablecoin trading, low risk, supplemental fee income liquidity aggregator, where anyone can add their assets to several different liquidity pools and earn fees.

PROS

- Large number of liquidity pools to select from

- Virtually unmatched exchange rates on stablecoins

- Has some of the largest liquidity/volumes of any DEX

- Decentralized with good incentives for CRV holders

- Supports yield farming at low-interest rates

CONS

- Complex user interface

- High gas fees

- No chat support on the website

Background Information About Curve Finance

Headquartered in Switzerland, Curve Finance serves as one of the largest DeFi platforms by volume and has amassed tremendous liquidity since its launch. Michael Egorov is the CEO of Curve Finance.

One of the easiest ways to understand Curve Finance is to see it as an exchange. It is a decentralized exchange liquidity pool built on Ethereum, allowing the stablecoin trading and liquidity pool providers to earn income from trading fees with minimal risk. Curve Finance protocol gives users and smart contracts the ability to trade between stablecoins with low slippage and fees due to its high available liquidity. Moreover, it is non-custodial, meaning the Curve developers do not have access to your tokens.

How to Get Started at Curve Finance?

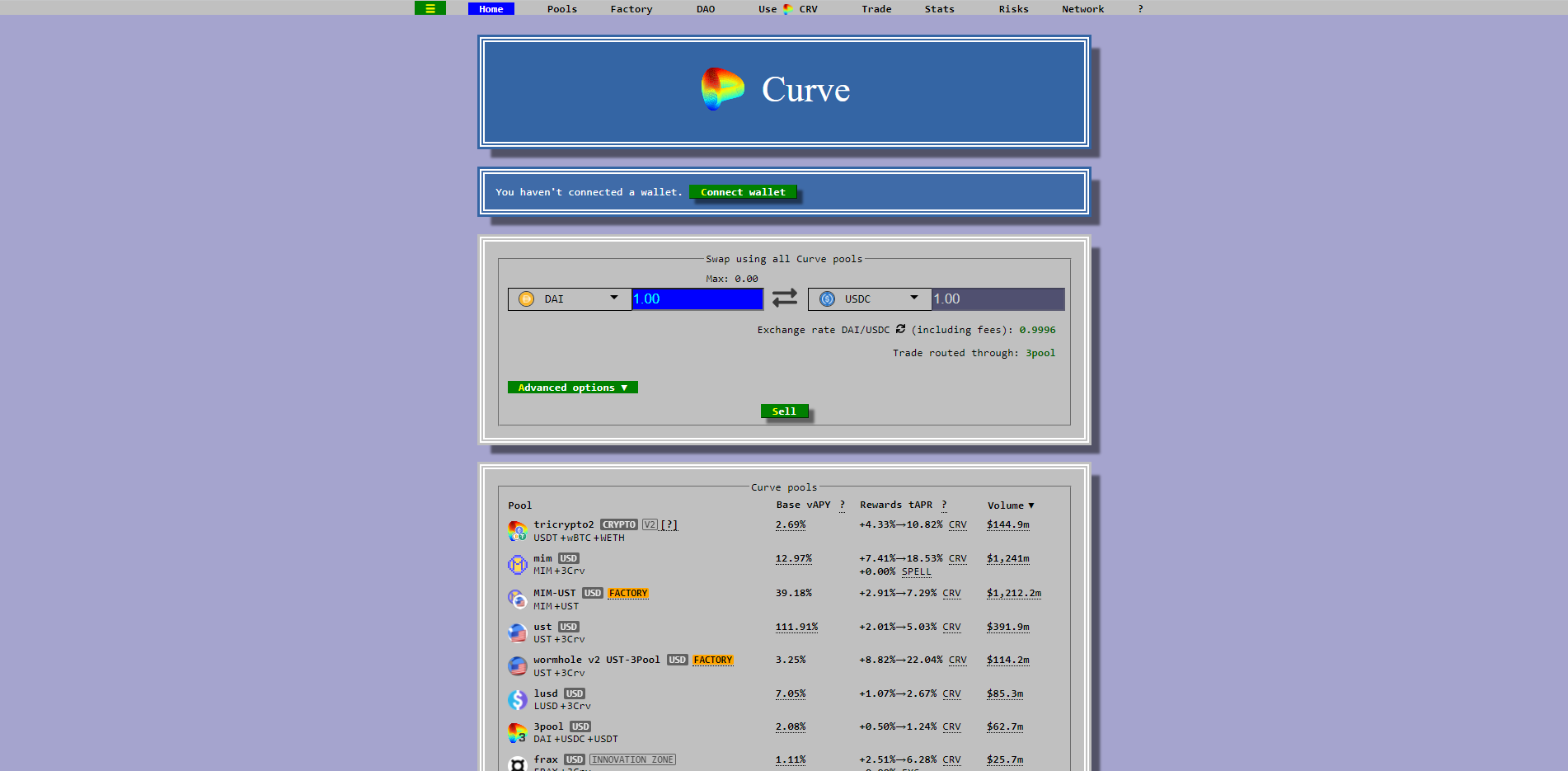

One of the biggest advantages of using Curve Finance is the different options you get for trading. However, the associated cost with this is the complexity of using the platform, as it can be a bit confusing.

To use the Curve Finance protocol, you need to connect your Ethereum wallet with the protocol. The different wallets supported by Curve Finance include Metamask, Trezor, Ledger, Coinbase Wallet, Lattice, Opera, among others. These wallets are used to send, receive, and store digital assets. They come in different forms like a browser extension, built-in within browsers, a part of hardware plugged into your computer, or an app on your phone.

Once you connect to the wallet, you need to stay on the homepage of Curve Finance, where you will have the option to either swap tokens or provide tokens to the liquidity pools.

For swapping a token, you need to select the two coins you want to exchange and click on the “Sell” button. Next, your Ethereum wallet will pop up and ask you to approve Curve to interact with your wallet balance. Once this is done, you need to complete the transaction. The process is complete now.

How to Deposit and Withdraw at Curve Finance?

To deposit and withdraw your digital tokens at Curve Finance, you can use Ethereum wallets (like Metamask, Trezor, Ledger, Coinbase Wallet, etc.). With this, it is easy for you to manage your funds and interact with the platform. After all, your tokens are stored in your wallet, and you can deposit or withdraw at any time.

Curve Finance supports only crypto-crypto transactions, and you cannot directly deposit fiat onto Curve. Thus, you have to go through a fiat-supported exchange to make your crypto purchases and transfer them to your Ethereum wallet.

What is Curve DAO?

In August 2020, Curve Finance launched a decentralized autonomous organization (DAO) to help manage changes to the protocol. This CRV token controls the Curve DAO protocol, ensuring that this system remains decentralized and that the power remains with the users of the platform to make the appropriate/necessary changes.

The main purpose of the Curve DAO token is to incentivize liquidity providers on the Curve Finance platform and get as many users involved as possible in the governance of the protocol.

Frequently Asked Questions About Curve Finance

1. Is Curve Finance secured?

Yes, Curve is a secured platform. Their smart contracts are audited by Trail of Bits and Quantstamp.

2. What is the CRV token?

CRV token is a governance and utility token for Curve Finance. All users who have participated in the Curve pools will retroactively receive CRV tokens

3. What are swap fees at Curve?

At Curve, the swap fees are 0.04%which is thought to be the most efficient when you exchange stable coins on Ethereum.