Compound Finance

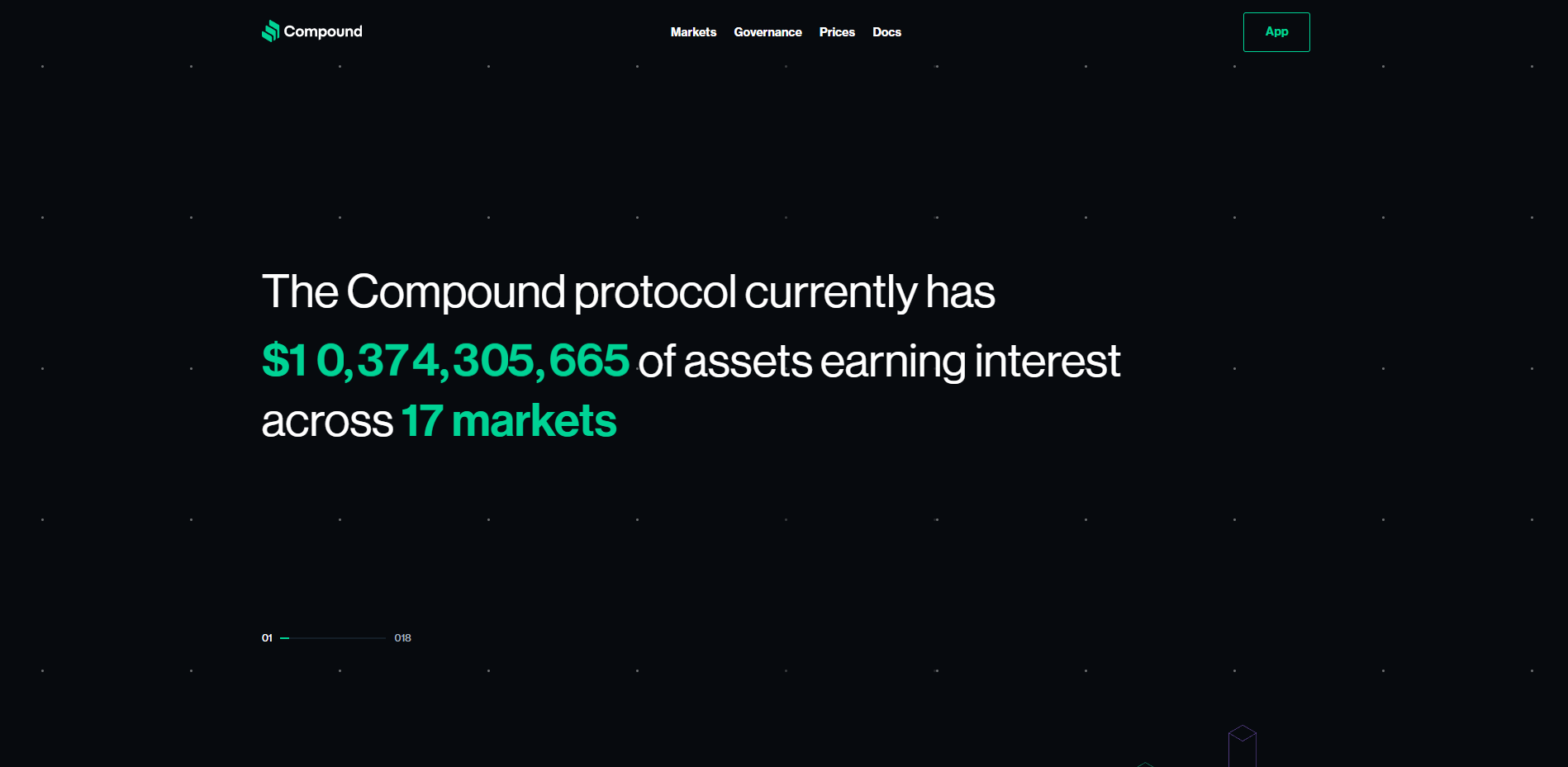

Compound Finance is a leading DeFi lending protocol, and it allows its users to earn interest on their crypto assets. Users do not have to go through a typical KYC process common among traditional banking service providers. Instead, it relies on smart contracts to remove the need for a middleman to offer interest-earning accounts.

The protocol calls Compound Finance – “Algorithmic Autonomous Interest Rate Protocol.” Any developer who wants to build open financial applications can do on Compound Finance and unlock the true potential of the DeFi space.

PROS

- Easy-to-use interface

- High liquidity

- Available globally

- High level of privacy

- No time limitation as users are allowed to borrow or lend assets for an indefinite period

- Well-funded by top blockchain findings

CONS

- It supports native Ethereum assets only

- No live chat support

Background Information About Compound

Founded in 2017 by Geoffrey Hayes and Robert Leshner, Compound Finance is an open-source interest rate protocol that unlocks new financial applications for developers.

Built on the Ethereum blockchain, you can access Compound Finance protocol using several interfaces such as Coinbase and Huobi wallets. It offers a web interface that adjusts money market interest rates based on asset-specific supply and demand.

How to Earn and Borrow Ethereum Assets at Compound?

To get started with Compound Finance, you need to follow the below steps:

1. Connect Your Wallet

Once you visit the website of Compound, you will see a pop-up asking you to connect to your Ethereum wallet. These wallets secure the private keys to your crypto and enable you to authorize transactions and view balance on the Ethereum blockchain.

To create Ethereum transactions, you need to ensure that your wallet contains at least 0.05 Ether. If you prefer, you can also connect to a digital wallet supporting Ethereum. Compound supports multiple digital wallets like MetaMask, Ledger, Coinbase Wallet, among others. Choose a wallet that best fits your needs.

2. The Compound Dashboard

Once you connect to the wallet to the Compound Protocol, your Ethereum address will appear in the top-right of the screen. On the top of the screen, you can see the value of your Supply Balance and Borrow Balance; kindly note at first, both of these will be $0.

On the left-hand side, you can see Supply Markets. These are assets that you can use to supply Compound to earn interest. On the right-hand side, there are Borrow Markets. You can use them to borrow from Compound.

3. Supplying Assets to Earn Interest

i) First, you need to click on the asset that you would like to supply.

ii) You will get a pop-up displaying the Supply APY (amount of token/year) and the Distribution APY (amount of COMP/year) you will earn by Supplying the asset.

iii) Before you can Supply an asset, you must “Enable” it first. It helps the Compound protocol to interact with the asset in your wallet. Then, click on “Enable” and submit the transaction.

iv) If you want to “Supply” an asset, you need to type the quantity you want to supply at the top of the pop-up. Next, your wallet balance will be displayed and can be entered with the “Max” button. Next, you need to click on “Supply” and submit the transaction.

4. Claiming COMP

In the top-right of your dashboard, you can see your COMP balance. Click on the number, and a pop-up will appear. To collect your earned COMP, you have to click on “Claim” and submit the transaction.

5. Borrowing Assets

The Compound protocol allows you to borrow any supported asset, using your Supply balance as Collateral. To borrow assets-

i) Click on the asset that you would like to borrow

ii) You will get a pop-up displaying the Borrow APY (amount of token/year) you will pay and the Distribution APY (amount of COMP/year) you will earn by borrowing the asset.

iii) To borrow an asset, type the quantity you would like to borrow at the top of the pop-up. Click on the “Borrow” button, and submit the transaction.

What can You Build With Compound Governance?

The Compound protocol also has a decentralized governance system in which application developers can build their own custom workflows and interfaces to facilitate the participation of their users and communities in Compound governance. For example, the applications integrated with Compound’s interest rate markets may be interested in adding governance functions such as:

- Encourage users to delegate COMP voting power to the application team’s address. So, the teams can participate in governance on behalf of users.

- Give users transparent insights of upcoming potential changes to Compound including, proposals for adding new markets or other upgrades.

- Materializing specific governance proposals to users so that users with COMP can vote on them directly.

Frequently Asked Questions About Compound Finance

1. Is Compound protocol safe?

Yes, it is a safe protocol. At Compound, all contract codes and balances are publicly verifiable. The Compound protocol has been reviewed and audited by Trail of Bits and OpenZeppelin.

2. How is interest calculated at Compound?

The interest rates you see on the Compound interface are quoted as annual interest rates. The interest accrues for each Ethereum block every 15 seconds. The user balances will increase by (1/2102400) of the quoted interest rate.

3. What are the gas costs at Compound?

At Compound, the usage of the protocol functions may fluctuate by market and user. External calls, such as to underlying ERC-20 tokens, may use an arbitrary amount of gas. Any calculations that involve checking account liquidity have gas costs that increase with the number of entered markets.